Smart home system and its impact on home insurance – Smart home systems and their impact on home insurance are taking center stage in the evolving landscape of homeownership. As technology seamlessly integrates into our lives, smart home devices are no longer a luxury but a growing necessity, offering enhanced security, efficiency, and peace of mind.

These systems, equipped with sensors, cameras, and automated controls, have the potential to revolutionize how we protect our homes and how insurance companies assess risk.

This article delves into the intricate relationship between smart home technology and home insurance, exploring the potential benefits, challenges, and future implications. From analyzing how smart home features can reduce insurance premiums to examining the ethical considerations surrounding data privacy, this exploration sheds light on a dynamic intersection of technology and financial security.

Introduction to Smart Home Systems

Smart home systems are interconnected networks of devices and appliances that can be controlled and monitored remotely, often through a central hub or app. These systems utilize various technologies, including the Internet of Things (IoT), artificial intelligence (AI), and cloud computing, to automate and enhance everyday tasks and functions within a home.The increasing popularity and adoption of smart home technology can be attributed to several factors, including the desire for convenience, improved safety and security, energy efficiency, and enhanced accessibility.

The adoption of smart home systems has significantly impacted the home insurance industry. Insurance companies are increasingly offering discounts to homeowners who install smart devices, recognizing the potential for these systems to prevent and detect incidents like burglaries, fires, and water damage.

While these systems offer numerous benefits, choosing the right system for a small apartment can be challenging. A comprehensive guide on the Best Smart Home System for Small Apartments can help homeowners make an informed decision, ultimately leading to greater security and potentially lower insurance premiums.

The affordability of smart home devices, coupled with advancements in technology and the growing availability of high-speed internet, have also contributed to its widespread adoption.

Components of Smart Home Systems

Smart home systems typically consist of a range of interconnected devices, each serving a specific purpose. These components can be broadly categorized as follows:

- Control Hubs:These act as the central brain of the smart home system, connecting and coordinating various devices. Examples include Amazon Echo, Google Home, and Apple HomePod.

- Smart Appliances:These include refrigerators, ovens, washing machines, and dryers that can be controlled remotely, monitored for energy consumption, and even programmed to perform specific tasks.

- Security Systems:Smart security systems offer features such as remote monitoring, motion detection, and door/window sensors, providing enhanced security and peace of mind.

- Lighting Systems:Smart lighting systems allow for remote control of lights, scheduling, and even the creation of customized lighting scenes for different moods or activities.

- Thermostats:Smart thermostats learn user preferences and automatically adjust the temperature to optimize energy efficiency and comfort.

- Sensors:These devices detect and measure various parameters, such as temperature, humidity, motion, and light levels, providing valuable data for home automation and monitoring.

- Smart Speakers:These devices allow for voice control of various smart home devices and access to information and entertainment.

Functionalities of Smart Home Devices

Smart home devices offer a wide range of functionalities, significantly impacting the way we live and interact with our homes. Some of the key functionalities include:

- Remote Control:Users can control and monitor smart home devices from anywhere with an internet connection, allowing for convenient operation and management of appliances, lighting, and security systems.

- Automation:Smart home systems can be programmed to perform tasks automatically, such as turning off lights when a room is empty, adjusting the thermostat based on occupancy, or locking doors at a specific time.

- Energy Efficiency:Smart devices can monitor energy consumption and optimize settings to reduce energy waste, contributing to cost savings and environmental sustainability.

- Enhanced Security:Smart security systems provide real-time monitoring, motion detection, and remote access to security cameras, offering enhanced protection against intruders and other threats.

- Accessibility:Smart home technology can make homes more accessible for people with disabilities, enabling them to control appliances, lighting, and other functions with ease.

- Personalized Experiences:Smart home systems can learn user preferences and habits, providing personalized experiences and customized settings for individual needs and preferences.

Smart Home Features and Their Insurance Implications

Smart home technology has become increasingly popular in recent years, offering homeowners a wide range of benefits, including enhanced security, convenience, and energy efficiency. As smart home systems become more sophisticated and integrated into our lives, they are also having a significant impact on the home insurance industry.

The integration of smart home systems has not only revolutionized home convenience but also influenced the landscape of home insurance. By leveraging sensors and automation, these systems can detect and prevent potential hazards, leading to lower premiums and increased coverage for homeowners.

The sleek design and intuitive interfaces of these systems, as seen in Smart Home System with Sleek Design: Enhancing Convenience Efficiency and Aesthetics , further contribute to their appeal, encouraging wider adoption and ultimately impacting the future of home insurance.

This section explores some of the key smart home features and their implications for insurance coverage and premiums.

The adoption of smart home systems is rapidly growing, influencing not only the convenience of daily life but also the landscape of home insurance. As these systems become more integrated into our homes, they offer potential benefits like automated security features and remote monitoring, which can lead to reduced premiums.

However, the increasing reliance on interconnected devices also presents significant security vulnerabilities, making it crucial to address these concerns. A comprehensive understanding of Smart Home System Security Risks and Mitigation Strategies is essential for insurers to accurately assess risk and develop appropriate policies that account for both the benefits and vulnerabilities of smart home technology.

Smart Home Features and Their Insurance Implications

Smart home features can offer significant benefits in terms of safety, security, and energy efficiency, which can directly impact insurance premiums. The following table provides a detailed overview of various smart home features, their potential insurance benefits, illustrative examples, and explanations:

| Smart Home Feature | Insurance Benefit | Example | Explanation |

|---|---|---|---|

| Smart security systems (alarms, cameras) | Reduced risk of theft, potential discounts | Home security system with remote monitoring | Smart security systems can deter crime by providing a visible deterrent and notifying homeowners and authorities in case of a break-in. They can also provide valuable evidence for insurance claims by capturing footage of the incident. Insurance companies may offer discounts for homes equipped with such systems, recognizing the reduced risk of theft. |

| Smart smoke detectors and fire alarms | Early fire detection, potential discounts | Smoke detector connected to a home automation system | Smart smoke detectors can detect fire early, alerting residents and emergency services quickly. They can also be integrated with home automation systems to trigger other safety measures, such as shutting off gas and electricity. Insurance companies may offer discounts for homes with interconnected smoke detectors, recognizing the reduced risk of fire damage. |

| Smart water leak detectors | Prevention of water damage, potential discounts | Water leak detector connected to a smart home system | Smart water leak detectors can detect leaks and automatically shut off the water supply, preventing costly water damage. Insurance companies may offer discounts for homes with such systems, recognizing the reduced risk of water damage claims. |

| Smart thermostats and energy management systems | Energy efficiency, potential discounts | Smart thermostat that automatically adjusts temperature based on occupancy and weather conditions | Smart thermostats and energy management systems can optimize energy consumption, reducing utility bills and minimizing the risk of energy-related accidents. Insurance companies may offer discounts for homes with such systems, recognizing the reduced risk of accidents and the positive environmental impact. |

Insurance Policies and Smart Home Technology: Smart Home System And Its Impact On Home Insurance

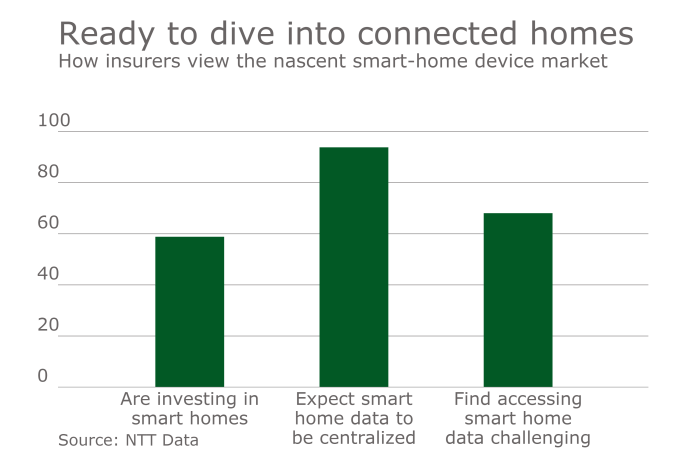

The integration of smart home technology is profoundly influencing the insurance landscape. Insurance companies are actively adapting their policies to account for the unique risk profiles and benefits associated with these connected homes. This adaptation is driven by the increasing adoption of smart home systems and the potential for these systems to enhance safety, security, and energy efficiency.

Smart Home Discounts, Smart home system and its impact on home insurance

Insurance companies recognize the potential of smart home technology to mitigate risks and are offering discounts to homeowners who install compatible systems. These discounts are often tied to specific features that demonstrably reduce the likelihood of claims, such as:

- Smart Smoke Detectors:These devices can detect fires earlier, providing valuable time for occupants to evacuate and for firefighters to respond. This early detection can significantly reduce fire damage and associated claims.

- Smart Security Systems:These systems can deter burglaries and provide real-time alerts to homeowners and authorities, reducing the risk of property theft and related claims.

- Smart Water Leak Detectors:These devices can detect leaks early, minimizing water damage and associated claims.

The availability of discounts varies by insurance company and region. It’s essential for homeowners to inquire about available discounts and the specific smart home features that qualify.

Data Privacy and Security in Smart Home Insurance

As smart home systems collect and transmit data about homeowners’ activities and property, concerns about data privacy and security are paramount. Insurance companies are incorporating provisions in their policies to address these concerns:

- Data Collection Transparency:Insurance companies are required to be transparent about the types of data they collect from smart home systems and how this data is used.

- Data Security Measures:Insurance companies are implementing robust security measures to protect homeowner data from unauthorized access or breaches. This includes encryption, access controls, and regular security audits.

- Data Ownership and Control:Homeowners should retain control over their data and have the right to access, modify, or delete it. They should also have the option to opt out of sharing data with insurance companies.

It’s crucial for homeowners to carefully review insurance policies and understand the terms related to data privacy and security. They should also prioritize using smart home systems with strong security features and regularly update their systems to address vulnerabilities.

Ending Remarks

As smart home technology continues to evolve, its impact on home insurance will undoubtedly become more profound. Insurance companies are adapting their policies to embrace the benefits of smart home systems while addressing the complexities of data privacy and security.

The future holds the promise of innovative insurance products tailored to the unique needs of smart home users, further blurring the lines between technology and financial protection. By understanding the interplay between smart home systems and home insurance, homeowners can leverage the benefits of technology to enhance their safety, security, and financial well-being.